However, the moving expense deduction continues to apply to a member of the. See Chapter 4 of Publication 54, Tax Guide for U.S. Taxpayers generally may not deduct moving expenses for tax years 2018 through 2025. You may also be able to claim a foreign housing exclusion or deduction. If you live and work outside the United States, you may be able to exclude from income all or part of the income you earn in the foreign country. In most cases, reimbursement of moving expenses is earned income. Moving expenses allocable to excluded foreign income Moving Expense Reimbursementsįor tax years 2018-2025, reimbursements for certain moving expenses are no longer excluded from the gross income of non-military taxpayers. citizen or resident alien to deduct your expenses. citizens or resident aliens for the entire tax year for which they're inquiring. The tool is designed for taxpayers who were U.S. Amount of moving expense reimbursements as shown on Form W-2. Information You'll Need Types and amounts of moving expenses. If the new workplace is outside the United States or its possessions, you must be a U.S. ITA Home This interview will help you determine if you can deduct your moving expenses. Use Form 3903, Moving Expenses, to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). If you must relocate and your spouse and dependents move to or from a different location, don't include in income reimbursements, allowances, or the value of moving and storage services provided by the government to move you and your spouse and dependents to and from the separate locations.Moving expense deduction eliminated, except for certain Armed Forces membersįor tax years beginning after 2017, you can no longer deduct moving expenses unless you are a member of the Armed Forces on active duty and, due to a military order, you move because of a permanent change of station. You can deduct the expenses that are more than your reimbursements in the year you paid or incurred the expenses. If your reimbursements or allowances are less than your actual moving expenses, don't include the reimbursements or allowances in income. However, if any reimbursements or allowances (other than dislocation allowances, temporary lodging expenses, temporary lodging allowances, or move-in housing allowances) exceed the cost of moving and the excess isn't included in your wages on Form W-2, the excess still must be included in gross income on Form 1040, 1040-SR, or 1040-NR, line 1h. Generally, if the total reimbursements or allowances that you receive from the government because of the move are more than your actual moving expenses, the government must include the excess in your wages on Form W-2. Similarly, don't include in income amounts received as a dislocation allowance, temporary lodging expense, temporary lodging allowance, or move-in housing allowance.

#REPORT MILEAGE FOR MOVING EXPENSES TAX DEDUCTION CODE#

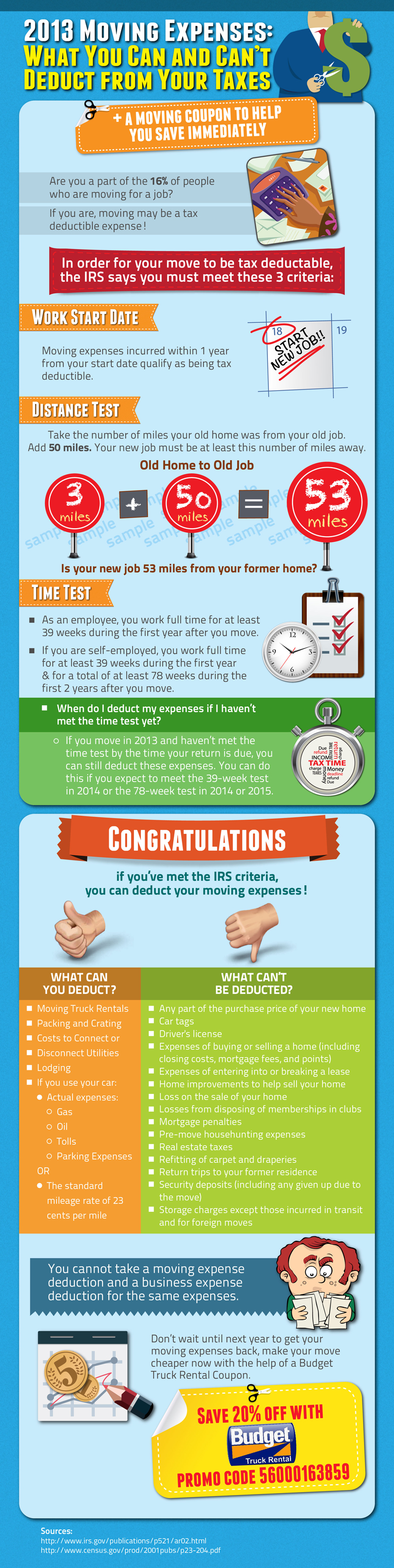

You can only deduct moving expenses which are work-related those which are for purely personal reasons (a. What does the Tax Cuts and Jobs Act mean to me How does the TCJA affect my taxable income Will my Relocation Income Tax Allowance claim be affected How. Moving expenses were tax-deductible if you relocated to start a new job or to seek work until the Tax Cuts and Jobs Act (TCJA) eliminated this provision from the tax code for most taxpayers in 2018. Services or reimbursements provided by government.ĭon't include in income the value of moving and storage services provided by the government because of a permanent change of station. Fortunately for us, the cost of our move is deductible.

0 kommentar(er)

0 kommentar(er)